who do i call about a state tax levy

State Tax Levy Everything You Need to Know to Stop a Tax Levy Need tax help. This step usually occurs after you file your tax.

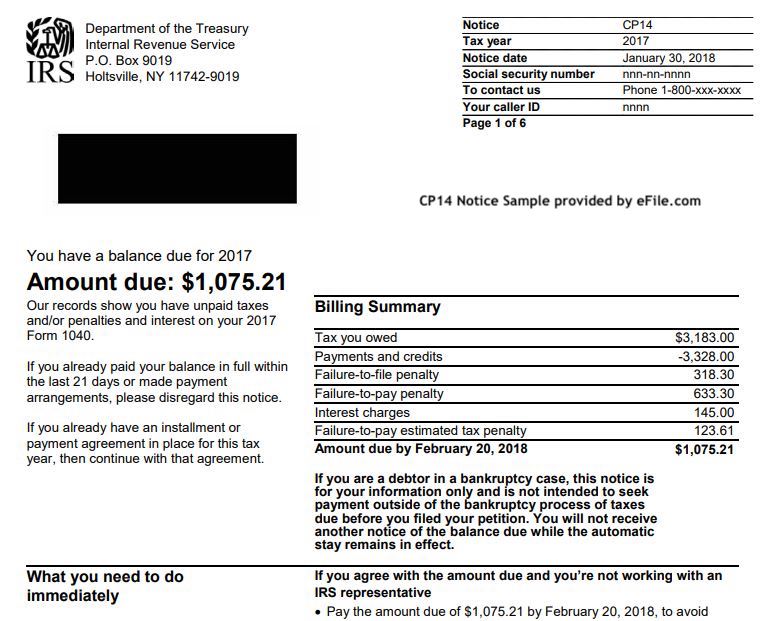

Irs Levy Cp504 Notice Of Intent To Levy What You Should Do

The current total local sales tax rate in Houston County GA is 7000.

. The first is assessing the tax you owe. Federal and State Levy Programs If your federal payments state income tax refund or Alaska Permanent Fund Dividend have been levied this section will give you information on who to. Tax levies are collection methods used by the IRS where they can legally seize your assets to cover back taxes.

Call us today for a free consultation and to get more information about state tax problems and. The state and IRS notices refer you to call 800 829-7650 or 800 829-3903 for assistance. How do I contact the IRS about a levy.

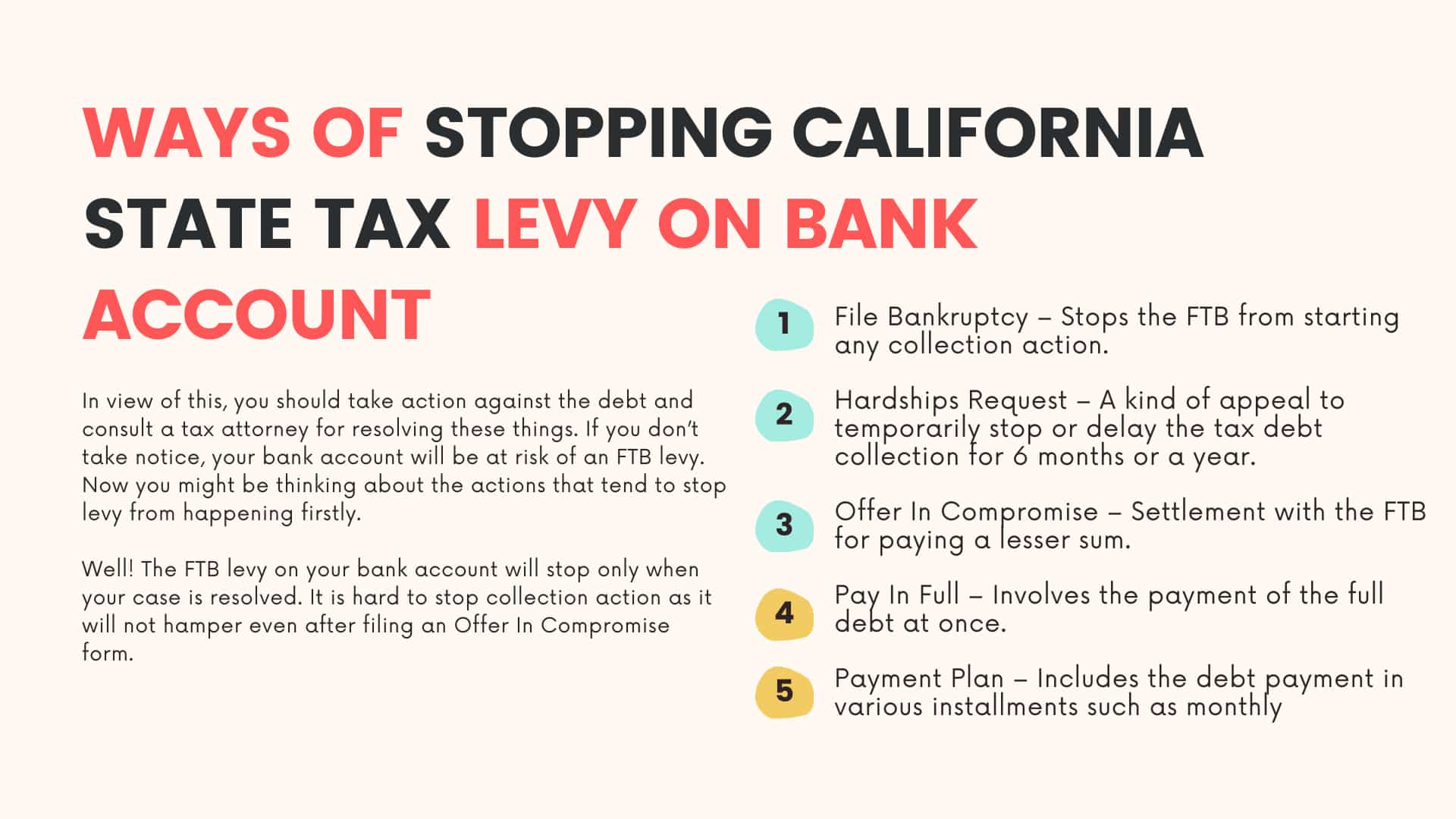

CALL 800-804-2769 FOR IMMEDIATE HELP. Who do I call about a state tax levy. Visit the Franchise Tax Board website their help page or find a local office.

The December 2020 total local sales tax rate was also 7000. If you need additional help appealing a tax levy in order to get it released ask a certified public accountant CPA Enrolled Agent EA or local tax attorney how to proceed. You dont have to face your state tax levy problem alone.

Levies If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. You can contact the SCDOR office near you to request a Payment Plan Agreement for business taxes. As the largest tax representation provider in the country TaxAudit handles more audits than any other firm and also offers Tax Debt Relief Assistance to taxpayers who owe.

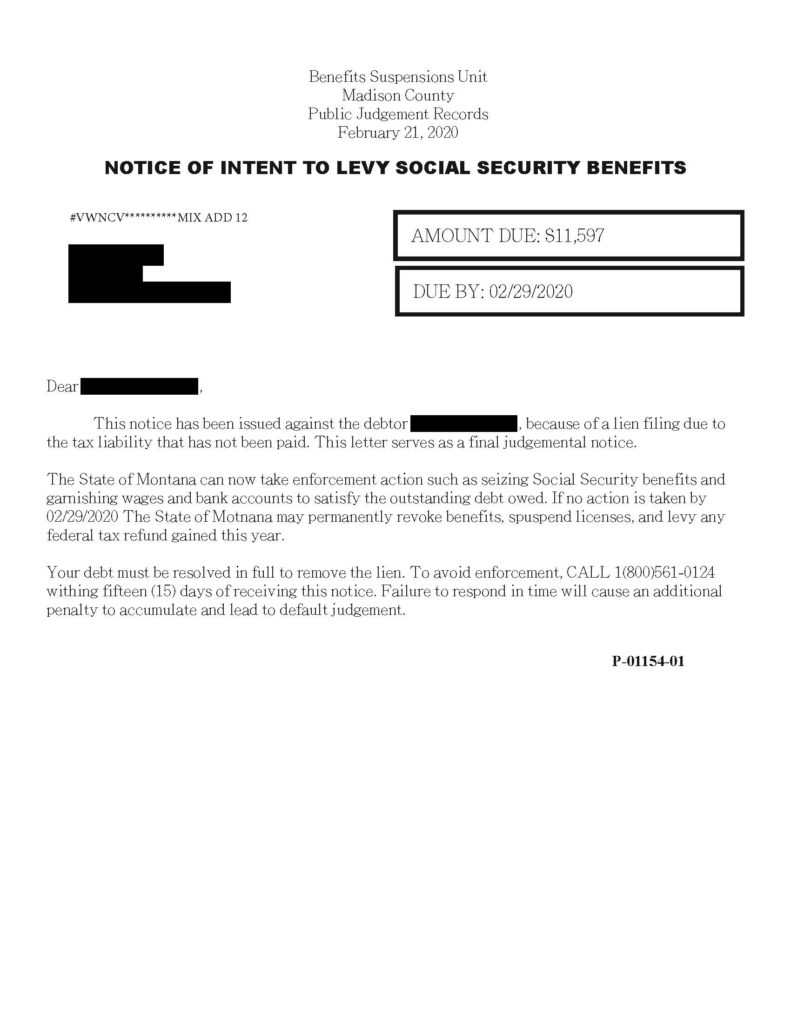

Omni Tax Solutions is here to help. OR To request a Payment Plan Agreement by paper print and mail a completed FS-102. If you receive an IRS bill titled Final Notice Notice of Intent to Levy and Your Right to A Hearing contact the IRS right away.

IRS Tax Levy Process. To find out where to send an income tax return refer to Mailing Addresses. What is the difference between a tax levy.

California taxpayers can take advantage of several ways to get. For the status of your state tax. An IRS tax levy is a legal seizure of your property to compensate for your tax.

Entering a payment arrangement paying in full and successfully seeking hardship status will result in levy release. It is different from a lien while a lien makes a claim to your assets. A state tax levyis a collection method that tax authorities.

Before issuing a levy the IRS will go through several key steps. Resolving your federal tax liabilities with your citymunicipal tax refund through the. The state and IRS notices refer you to call 800 829-7650 or 800 829-3903 for assistance.

Liens are filed with the county Register of Deeds andor the Secretary of State as security that a debt will be paid from proceeds when a taxpayer sells real or personal property. A property tax levy is the right to seize an asset as a substitute for.

How Social Security Garnishment Works With Federal Back Taxes

Who Do I Call About A Tax Levy

Ohio Bill Targets Property Tax Levy Language Changes Education Groups Among Opponents Police Fire Roads Politics Education Jobs Economy Real Estate Mike Dewine

Irs Just Sent Me A Notice Of Intent To Seize Levy Your Property Or Right To Property Cp 504 What Should I Do Legacy Tax Resolution Services

Irs Bank Levy Release Services Lifeback Tax

Irs Notice Cp504 Is A Levy Really Coming

How Do State And Local Sales Taxes Work Tax Policy Center

New York State Tax Officials Warn Of New Scam Wrgb

Irs State Tax Levy Guide How They Work How To Stop Help

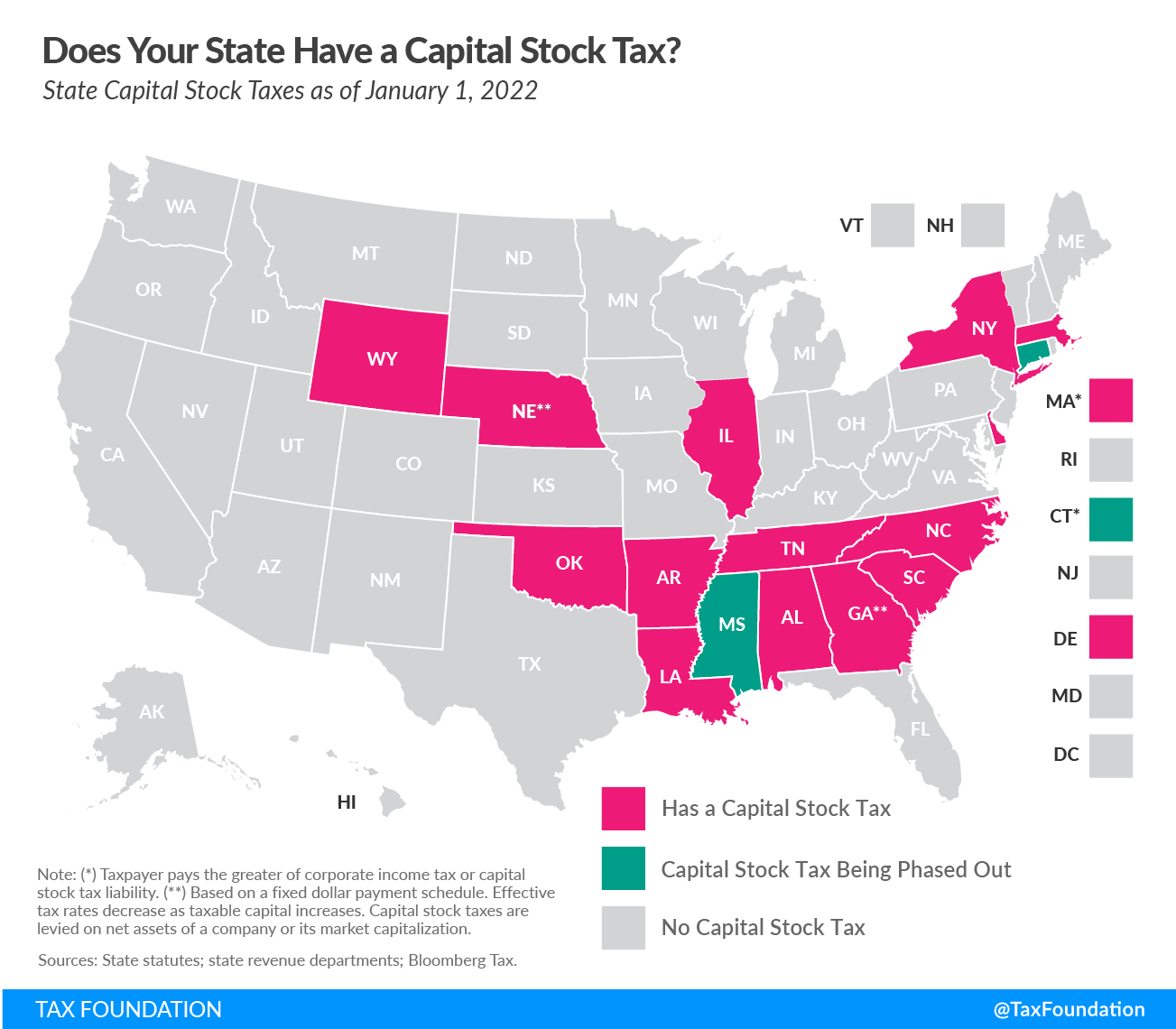

Does Your State Levy A Capital Stock Tax Tax Foundation

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

How Do State And Local Individual Income Taxes Work Tax Policy Center

What Is A State Tax Levy State Income Tax Levy Program

State Bank Levy How To Where To Get Help With Bank Levies

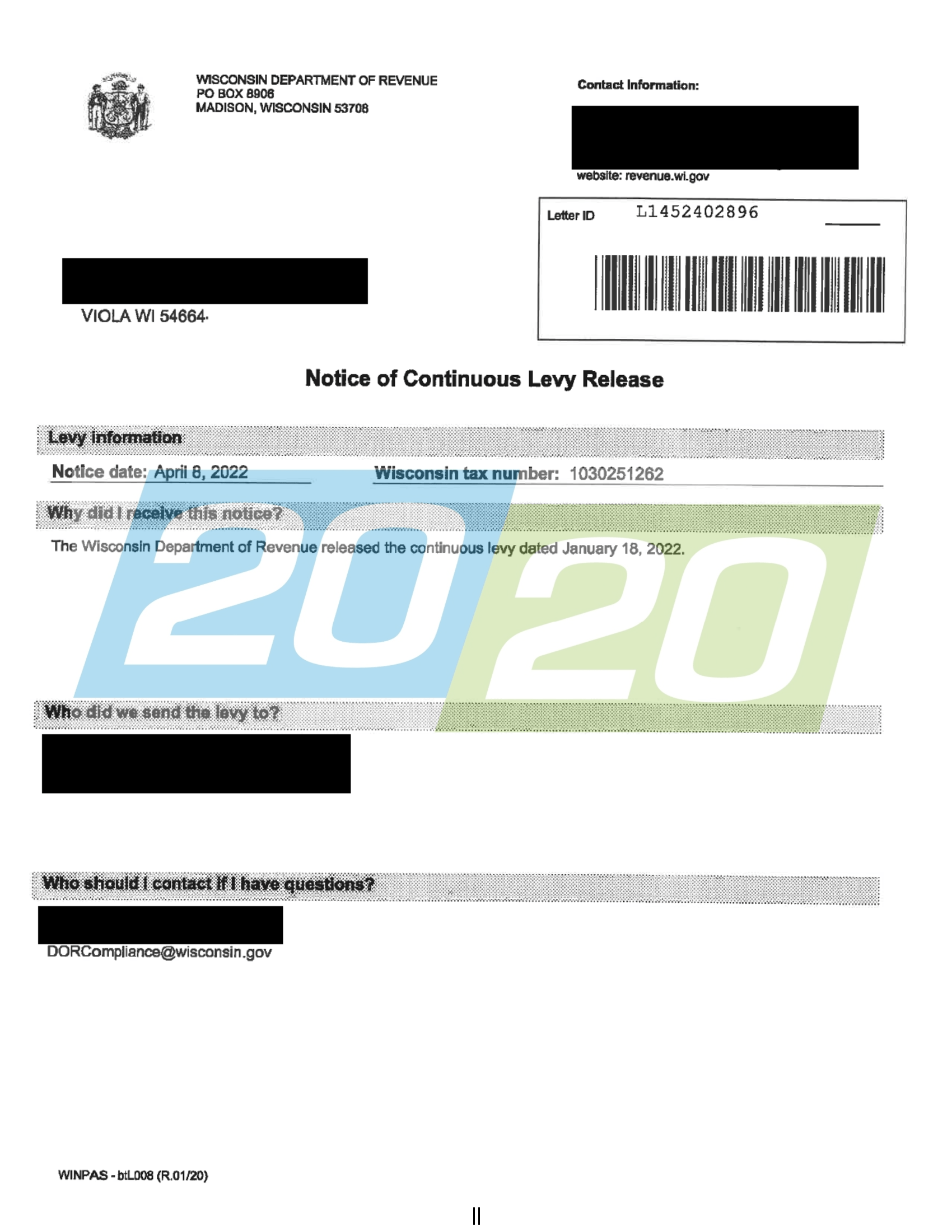

State Levy Release Archives 20 20 Tax Resolution

Tax Resolution Levy Associates

Department Of Revenue Warns Of Tax Scams Montana Department Of Revenue

3 Proven Ways To Stop California State Tax Levy On Bank Account